The mobile application market is forecast to reach a value of USD 626 billion by 2030, with a compound annual growth rate (CAGR) of 14.3% from 2024 to 2030. This growth is primarily driven by the global number of mobile phone users approaching 6 billion, with approximately 18.22 billion devices, and the increasing demand for mobile applications. The “Mobile App Trends 2025” report by Adjust also indicates that in 2024, consumer spending on mobile apps is expected to grow by 15.7% compared to the previous year, while the average daily usage time on smartphones has reached 5 hours.

In terms of mobile app segments, gaming remains dominant with a 39% market share. However, e-commerce and shopping apps are rapidly rising, accounting for 35% of the market share, up from 28% previously. Entertainment apps also saw impressive growth, from 27% to 33%, while travel and lifestyle apps also grew significantly, from 25% to 32% and from 19% to 30%, respectively.

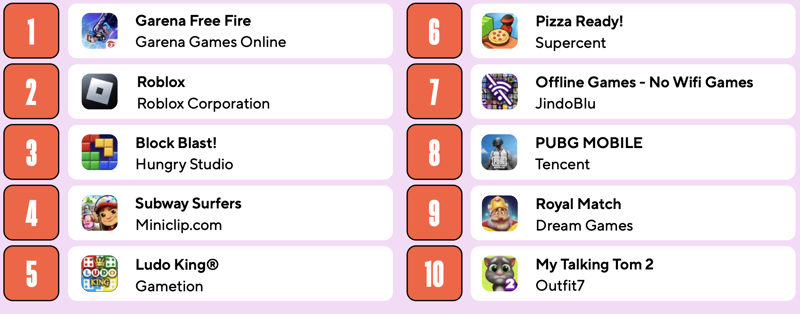

Top 10 most downloaded gaming applications in the world in 2024.

APAC LEADS ELECTRONIC COMMERCE GROWTH IN THE NEXT 5 YEARS

Global retail e-commerce sales are expected to exceed USD 8 trillion by 2027. In 2025 alone, mobile commerce revenue is projected to reach USD 2.5 trillion, an increase of 21.3% compared to the previous year. With a market value of USD 415 billion, APAC is expected to lead the growth rate of mobile commerce over the next five years.

In 2024, the number of e-commerce app installs is expected to rise by 17% year-over-year, while sessions are also expected to increase by 13%. Notably, the strong growth in the early months of the year has contributed to the overall growth, with installs in January, March, and April showing an impressive increase of about 60% compared to the previous year, while sessions in April surged by 25%.

However, this trend slowed down in Q4, with installs dropping below average in November (-5%) and December (-13%). Despite this, sessions in these two months still recorded slight increases, by 6% and 4%, respectively.

In terms of user behavior, the average session duration on e-commerce apps slightly decreased from 10.3 minutes in 2023 to 10.23 minutes in 2024.

Growth Rate of Installations and Session Numbers for E-commerce Apps (%), 2023-2024 – Source: Adjust.

MOBILE GAME REVENUE EXPECTED TO REACH 126 BILLION USD THIS YEAR

According to forecasts, mobile game revenue will reach USD 126.1 billion by 2025. In 2024, gaming continues to be the most popular category on the App Store and Google Play. Notably, 13 out of the 15 highest-grossing new mobile games this year are from companies based in Asia.

Over the past year, mobile devices accounted for 49% of the total global gaming revenue, far surpassing consoles (28%) and PCs (23%). The number of mobile game players worldwide is expected to increase by 8% by 2025, reaching 1.9 billion users.

Latin America recorded the fastest growth rate in mobile gaming in 2024, with installs increasing by 8%. APAC also saw a 4% increase, but session numbers dropped by 3%. Meanwhile, the European market saw declines in both metrics, with installs decreasing by 1% and sessions down by 6%.

In 2024, hyper-casual games continue to dominate the market, accounting for 27% of total mobile game installs and 11% of sessions. Puzzle games have a balanced share between installs and sessions (both 11%). Action games, while only accounting for 10% of installs, have the highest session rate at 21%. Hybrid-casual games also stood out, with installs making up 11% and sessions 7%. Simulation and sports games remained popular, accounting for 8% and 7% of installs, respectively, while strategy and RPG games remained under 4%.

Strategy games led the growth in installs, with an 83% increase compared to the previous year. Hyper-casual and hybrid-casual games continued to soar with installs increasing by 14%, while sessions grew by 18% and 16%, respectively. Puzzle and simulation games also saw strong growth, with installs rising 12% and 25%, while sessions grew by 17%. In contrast, RPG games, despite a 32% increase in installs, saw a 12% decrease in sessions, indicating a drop in player engagement.

The average session duration for mobile games globally continued to rise, from 30.35 minutes in 2023 to 30.75 minutes in 2024. APAC continues to lead with average session duration increasing from 34.32 to 34.84 minutes, followed by MENA (30.04 to 30.58 minutes) and Europe (26.88 to 27.54 minutes). However, both North America and Latin America saw a slight decrease.

Despite a slight reduction in the number of sessions per user per day, the longer duration of each session means the total time users spend on mobile games remains relatively stable.

The ratio of paid to organic installs for mobile games globally increased slightly from 2.11 in 2023 to 2.18 in 2024. However, casino games saw a sharp decline from 6.24 to 3.52, possibly due to relaxed regulations in markets like the US and Brazil, which attracted large numbers of new players without heavy reliance on paid advertising. Meanwhile, puzzle and racing games continue to rely heavily on paid channels, with the ratio increasing from 2.88 to 3.44 and from 2.86 to 3.22, respectively.

GLOBAL MOBILE PAYMENTS WITH A COMPOUND ANNUAL GROWTH RATE (CAGR) OF 12.4% FOR THE 2025-2034 PERIOD

The global mobile payments market is expected to reach USD 1.25 trillion by 2024, with a compound annual growth rate (CAGR) of 12.4% during the 2025-2034 period. Of this, e-wallets are expected to account for more than 50% of total e-commerce transaction value by 2025, maintaining a CAGR growth of 15% until 2027. Notably, the global value of Buy Now, Pay Later (BNPL) transactions is expected to nearly double, from USD 334 billion in 2024 to USD 687 billion by 2028.

APAC leads in the growth rate of financial app installs in 2024, with an increase of 41% compared to the previous year. Meanwhile, Europe ranks number one for the number of sessions, with a significant rise of 63%. Latin America also saw a breakthrough, with a 29% increase in installs and a 50% increase in sessions. In contrast, North America experienced a 7% decrease in installs, although sessions increased by 20%.

In 2024, banking apps continued to show impressive growth, with installs rising by 33% and sessions increasing by 19% compared to the previous year. Cryptocurrency apps also recorded strong growth, with sessions soaring by 45%. Additionally, the number of sessions for payment apps grew by 29%, reflecting the increasing popularity of digital payment methods.

In the securities trading sector, app installs grew by 12%, and sessions increased by 20% compared to 2023, reflecting the growing demand for online investment platforms.

The average session duration for global financial apps increased from 6.29 minutes in 2023 to 6.66 minutes in 2024. North America led with the highest session duration, rising from 6.86 minutes to 7.84 minutes. APAC ranked second with an average of 7.12 minutes. Latin America and Europe also saw steady increases, reaching 5.48 minutes and 5.77 minutes, respectively. In contrast, the MENA region experienced a slight decrease, down to 6.62 minutes.

Based on the strong growth forecast for the mobile app, mobile gaming, and e-commerce markets, small and medium-sized enterprises (SMEs) in Vietnam need to be prepared to seize opportunities from these trends. The global mobile app and e-commerce markets will continue to expand, creating a highly competitive environment and opening up many growth opportunities for SMEs. To take advantage of this opportunity, businesses need to strengthen market research, develop strategies to reach users, and create innovative and efficient mobile apps and products. At the same time, optimizing digital marketing strategies will help businesses target the right customer segments and improve business effectiveness.

Sao Phuong Nam Development and Investment Consulting Joint Stock Company (SPN Invest) is a reputable firm in market research and strategy consulting for large enterprises both domestically and internationally. SPN Invest provides strategic solutions to help small and medium-sized businesses in Vietnam tap into new trends, improve business efficiency, and achieve sustainable growth in an increasingly competitive environment. With a team of experienced experts, SPN Invest is committed to delivering added value to clients through in-depth market research strategies and effective investment consulting.

English

English Tiếng Việt

Tiếng Việt Deutsch

Deutsch Japan

Japan