The Influencer Marketing Benchmark Report 2024 is our latest overview of the influencer marketing industry. It summarizes the thoughts of more than 3000 marketing agencies, brands, and other relevant professionals regarding the current state of influencer marketing, along with some predictions of how people expect it to move over the next year and into the future.

Notable Highlights

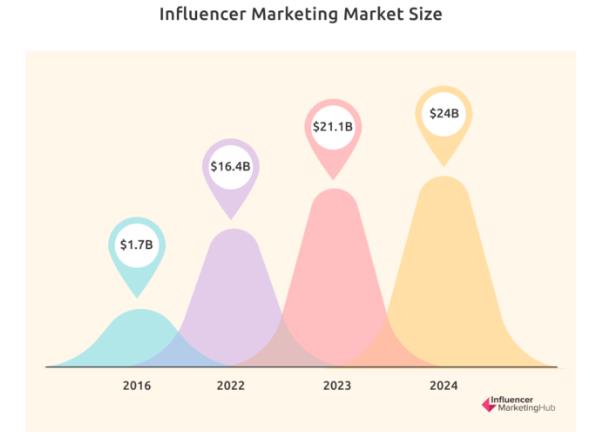

The Influencer Marketing Industry is set to grow to approximately $24 Billion by the end of 2024

63% plan to use AI in executing their influencer campaigns, 55% of these brands will use AI for influencer identification

85% of our survey respondents believe influencer marketing to be an effective form of marketing, an increase from previous years

75% admit to having increased the amount of content they produce and share

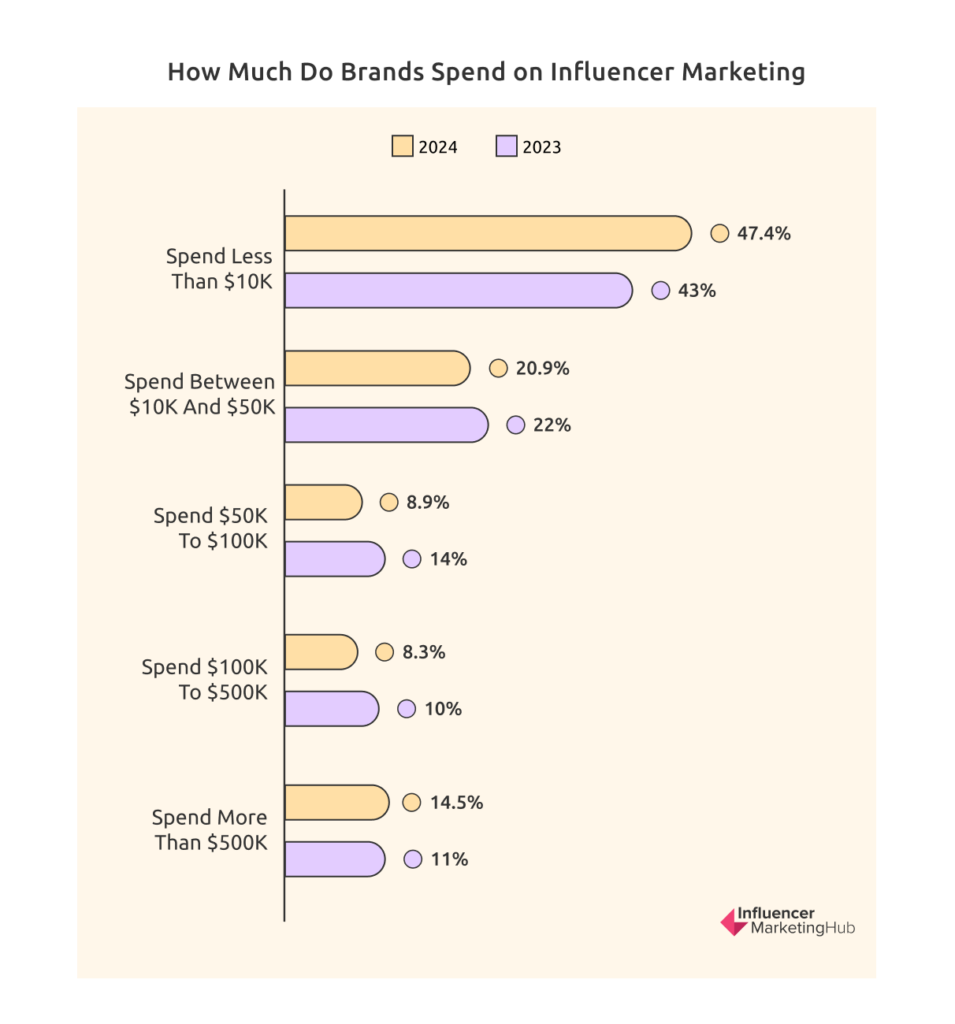

60% of those respondents who budget for influencer marketing intend to increase their influencer marketing budget over 2024

Nearly 1/4 of respondents intend to spend more than 40% of their entire marketing budget on influencer campaigns

There is a strong preference for working with small (nano – 44% and micro – 26%) influencers ahead of expensive macro-influencers (17%) and celebrities (13%)

It is now the norm to pay influencers (41%), rather than just give them a free product (31%).

TikTok (utilized by 69% of brands using influencer marketing) is by far the most popular influencer marketing channel, now well ahead of Instagram (47%), YouTube (33%) and Facebook (28%)

The main purpose of running influencer campaigns is to create User Generated Content (56%). Generating sales (23%) is a distant second.

Influencer Marketing Expected to be Worth $24 Billion by the End of 2024

Despite concerns that influencer marketing (indeed, all marketing) might decrease due to COVID-19, it didn’t and has continued to increase in popularity since 2020. Initially, some industries, such as tourism and airlines, had to cut back their operations and marketing, but many others adjusted their models to survive in the post-Covid world. Now there is renewed life in these more Covid-affected industries too.

Over the last couple of years, we have experienced a global economic downturn, and increasing inflation rates, making it more difficult for people to pay for their everyday purchases, never mind perceived extras. Firms must compete more fiercely for the consumer’s dollar, pound, or euro. Successful businesses understand the importance of marketing, including influencer marketing, in tough times, and increase their expenditures on this, even when they have to cost-cut expenses elsewhere.

From a mere $1.7 billion at the time of this site’s beginning in 2016, influencer marketing grew to have an estimated market size of $16.4 billion in 2022. It was then predicted to jump a further 29% to an estimated $21.1 billion in 2023. Despite these already impressive growth figures, the sector is expected to see even more robust expansion, with Influencer Marketing’s Hub predicting the market size to reach an estimated $24 billion by the end of 2024, indicating strong ongoing growth momentum in influencer marketing despite challenging economic conditions.

More Than 85% of Our Respondents Intend to Dedicate a Budget to Influencer Marketing in 2024

The general satisfaction felt by firms that have engaged in influencer marketing seems to flow through to their future planning. For example, 85.8% of our respondents indicated that they would be dedicating a budget to influencer marketing in 2024.

This is a moderate increase from last year’s 82% result and considerably up from the 37% who claimed they would dedicate a budget in our first survey in 2017. This continuing increase could result from firms increasing marketing to combat the effects of the current global financial crisis and other negative consumer sentiment.

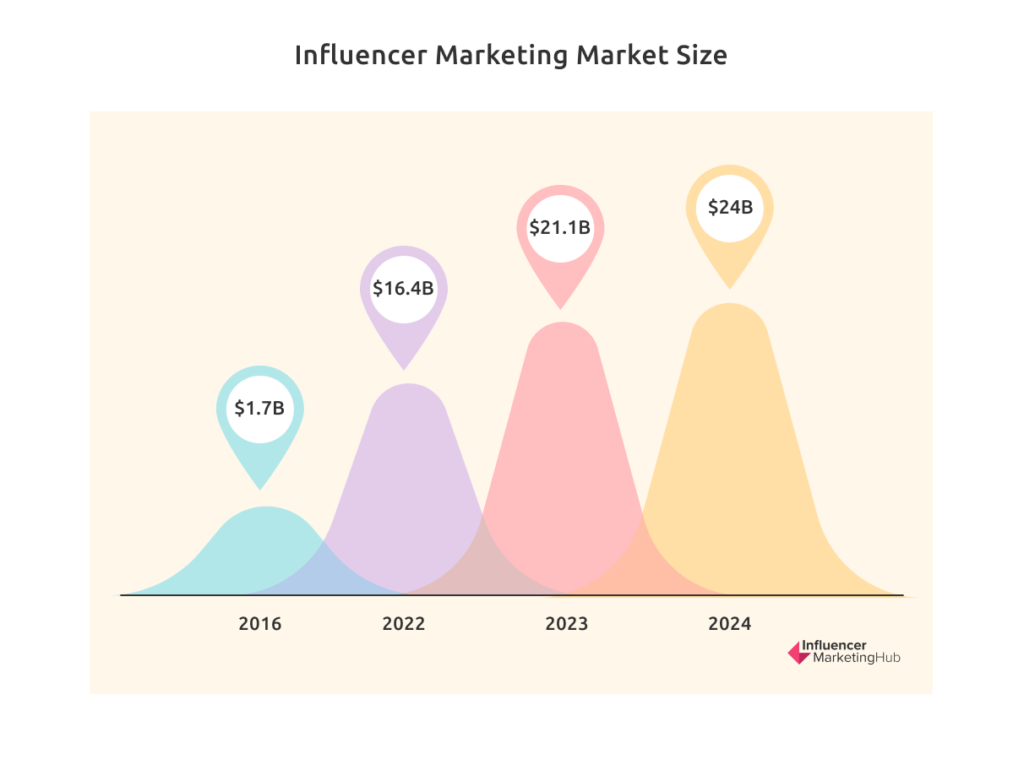

Nearly 60% of Respondents Intend to Increase Their Influencer Marketing Spend in 2024

59.4% of those respondents who budget for influencer marketing intend to increase their influencer marketing budget over the next 12 months. An additional 22.1% indicate that they expect to keep their budgets the same as in 2023. A further 9.3% stated that they were unsure how their influencer marketing budgets would change. This leaves just 9.3% intending to decrease their influencer marketing budgets.

These results suggest a sizable spending on influencer marketing in 2024, although at a slower rate than last year. The 9.3% planning to decrease their influencer marketing budget is slightly higher than last year’s 7% figure.

Although this is still proof that influencer marketing continues to be successful and is now sufficiently mainstream that it can’t be considered just a fad, it may indicate that budgets are stretched in these tough economic times, with some needing to find savings. Brands and marketers still recognize the effectiveness of influencer marketing, however, and don’t appear to be searching for something new. Further evidence of this can be seen in the next statistic.

26% of Respondents Intend to Spend More Than 40% of Their Marketing Budget on Influencer Marketing

Influencer marketing is, of course, merely one part of the marketing mix. Most businesses balance their marketing budget across a wide range of media to reach the greatest possible relevant audience. However, as we saw above, nearly 86% of our respondents’ firms intend to include some influencer marketing in their mix.

We notice a continuing trend in firms devoting a sizable percentage of their marketing budget to influencer marketing. Clearly, quite a few brands have found success with their influencer marketing and decided to return for more.

24.2% of respondents are dedicated fans of influencer marketing, intending to spend more than 40% of their marketing budget on influencer campaigns. This is comparable with 2023’s 23%, but much increased upon 2022’s 5%, 2021’s 11%, and 2020’s 9%.

11.5% of respondents (down from 13% in 2023) intend to devote 30-40% of their marketing budget to influencer marketing. An additional 15.8% plan to allocate 20-30% of their total marketing spending to influencer marketing.

22.4% of respondents expect to spend 10-20% of their marketing budget on influencer marketing this year. 26.1% expect to spend less than 10%, which is higher than last year’s 20%.

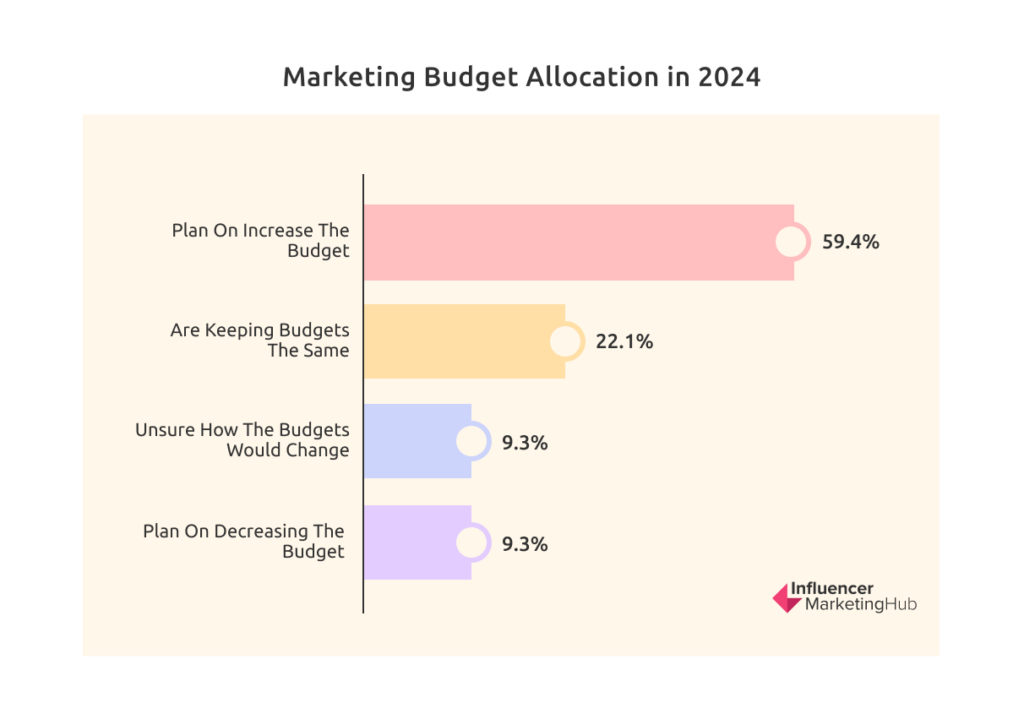

Although Most Brands Spend Less Than $50K on Influencer Marketing, Nearly 15% Spend Over $500K.

Brands of all sizes participate in influencer marketing. Therefore, it should be no surprise to see quite some variation in what firms spend on the activity. 47.4% of the brands surveyed said they spend less than $10K annually on influencer marketing (higher than last year’s 43% – these are probably a mix of newcomers dabbling with influencer marketing combined with more seasoned marketers operating with reduced budgets). 20.9% spent between $10K and $50K (down from last year’s 22%). A further 8.9% spent $50K to $100K (noticeably lower than 2023’s 14%), 8.3% $100K to $500K (down from 10%), with a sizable 14.5% spending more than $500K (up from last year’s 11% nearly 4x more than in 2022).

Clearly, the amount that a firm spends depends on its total marketing budget affects the proportion it chooses to devote to influencer marketing. Those brands that opt to work with mega-influencers and celebrities spend more than brands that work alongside micro- or nano-influencers. In 2022 we saw a leveling out of influencer marketing spending, with most brands spending a middling proportion of their marketing budget on influencer marketing. Last year, however, brands moved their spending sums to the extremes. Brands with happy influencer marketing experiences increased the percentage of their marketing budget they spent on the activity. However, brands that experienced less happy outcomes decreased or eliminated spending on the activity, turning their attention to other forms of marketing. This year saw a small movement back towards a more balanced pattern of spending.

TikTok Still Expected to Deliver the Best ROI for Short-Form Video

Until recently, the name TikTok was synonymous with short-term video, although ardent Snapchat fans may dispute this assessment. However, existing social media companies, YouTube and Meta (Facebook/Instagram) have been hit by the popularity of comparative newcomer, TikTok. Just as Instagram introduced Stories to try and neuter Snapchat, these older social channels have now introduced TikTok-killer features. You will undoubtedly notice YouTube Shorts, Instagram Reels, and even Facebook Reels in your feeds.

For the second year running, we asked our respondents about which they believed would deliver the best ROI (although we didn’t show Facebook Reels separately in our survey options). Last year we saw a surprisingly close battle for the top position between TikTok (42%) and Instagram Reels (34%).

This year, however, TikTok has reasserted itself at the top, with 50.1% support, ahead of 29.9% for Instagram Reels. A much reduced 12% believed YouTube Shorts would deliver the best ROI, alongside the usual diehard Snapchat disciples, with 8% opting for Snapchat Spotlights (who would undoubtedly point out that support for their platform has increased 33% from last year’s 6% figure). We won’t mention the words “margin of error” too loudly.

Strong Preference for Smaller Influencers

We asked those of our respondents intending to work with influencers this year the size of influencer (in terms of followers) they were most likely to utilize. If they used more than one type, they had to pick their preferred option.

44% of brands chose nano-influencers (1K-10K followers) as their most likely partners (up from 39%), followed by 25.7% opting for micro-influencers (10K-100K) (down from 30%).

Far fewer brands choose to place their focus on larger influencers, with 17.4% opting for macro-influencers (100K-1M) (down from 19%), and 12.9% mega / celebrity influencers (up slightly from 12%).

Influencer Preferences

This possibly reflects the reality of a small to medium-sized business. You simply can’t afford the fees charged by macro and mega-influencers. In addition, there are far fewer of these more popular influencers, limiting the number of brands they can work with. However, it may also reflect that nano and micro-influencers have far higher engagement rates than their more famous counterparts and may be better value for money for brands wanting to reach a specific dedicated audience.

More Brands Now Pay Influencers Than Give Them Free Product Samples

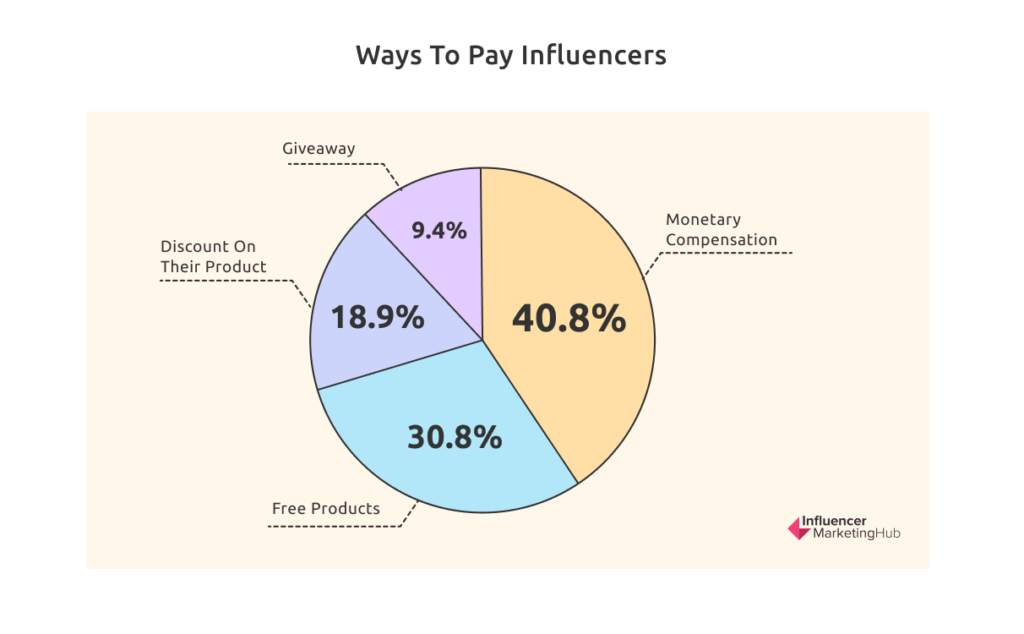

There has been a notable change in the answers to this question over time. Previously, those giving free samples outnumbered those paying cash to influencers. In 2022, numbers were approximately equal. However, last year, noticeably more respondents stated that they pay money to influencers, than give them free products. This trend has continued with 40.8% offering monetary rewards, 30.8% giving free product samples, 18.9% giving their influencers a discount on their product or services (presumably more expensive items), and a smaller 9.4% entering their influencers in a giveaway.

While more brands are willing to pay influencers for their marketing services, 40.8% is still a relatively low percentage, much less than half. It is probably a sign of just how many firms work with micro and nano-influencers. These relative newcomers are happy to receive payment in kind rather than cash. Presumably, it is mainly larger firms with more sizable marketing budgets that pay influencers with money. However, this is gradually changing as even nano and micro-influencers begin to understand their worth as advocates for a brand.

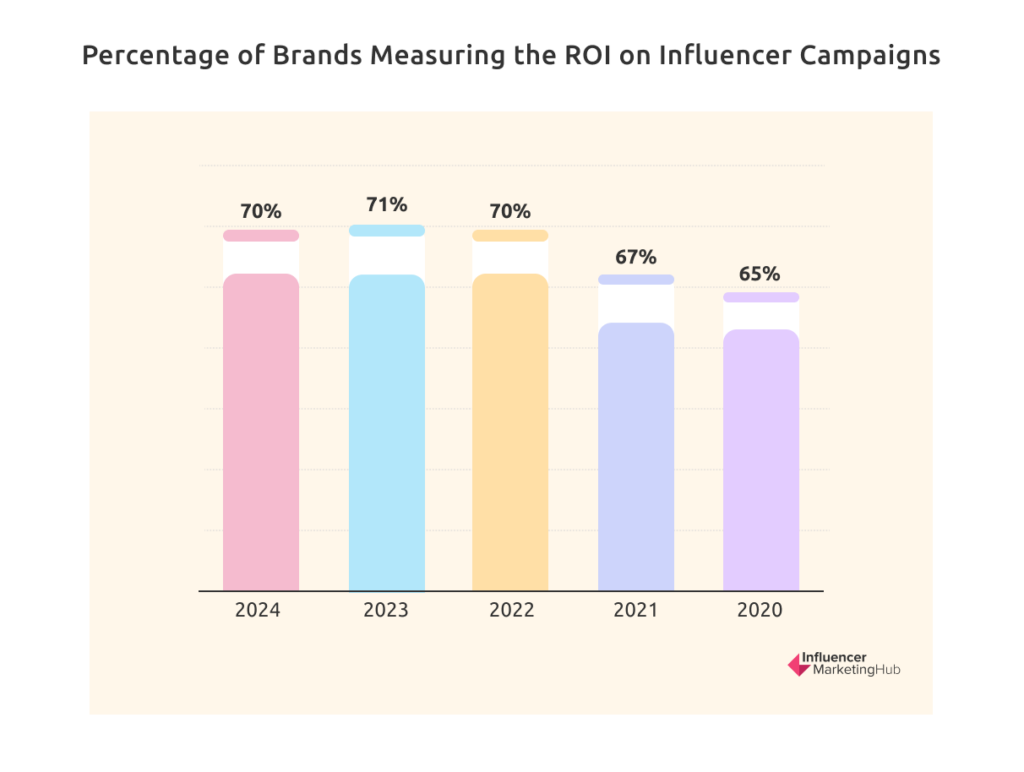

70% Measure the ROI on Their Influencer Marketing

We saw above that nearly 80% of our survey respondents stated that they track sales from their influencer campaigns. Therefore, it should be no surprise that a similar number (70%) also measure the ROI from their influencer campaigns. This is slightly down on 2023’s 71%, but better (or equal) to 2022’s 70%, 2021’s 67%, and 2020’s 65% results.

It is somewhat surprising that 30% of firms don’t measure their ROI. You would think that every firm would want to know how effective their marketing spending is. At least there is a gradual improvement in this metric, and hopefully, this trend will continue, if not accelerate.

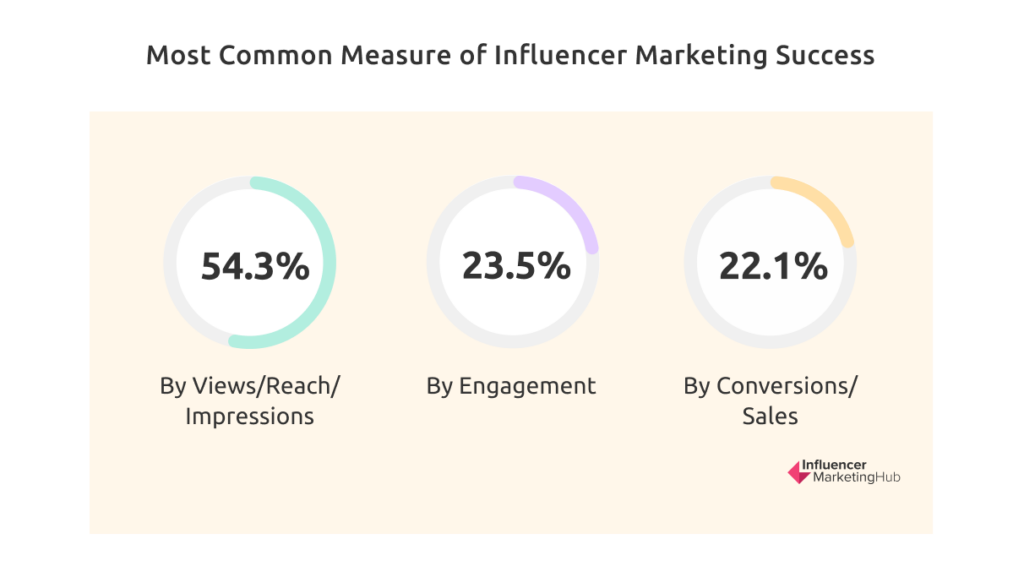

The Most Common Measure of Influencer Marketing Success is Views / Reach / Impressions

This result shows a marked change from previous years, yet it seems inconsistent with increases in firms tracking sales and paying influencers based on the sales they generate.

In 2019 and preceding years, influencer marketing measurement’s focus was relatively evenly balanced between differing campaign goals, but Conversion/Sales was the least-supported reason. However, in 2020 things changed, with Conversions/Sales taking a clear, undisputed lead, which continued in 2021 and 2022. In 2023, however, things changed with nearly half of our respondents stating that they measure the success of an influencer marketing campaign by views/reach/impressions.

This trend continued this year. An even higher 54.3% of our respondents stated that they measure the success of an influencer marketing campaign by views/reach/impressions, 23.5% by engagement or clicks, and just 22.1% by conversions/sales.

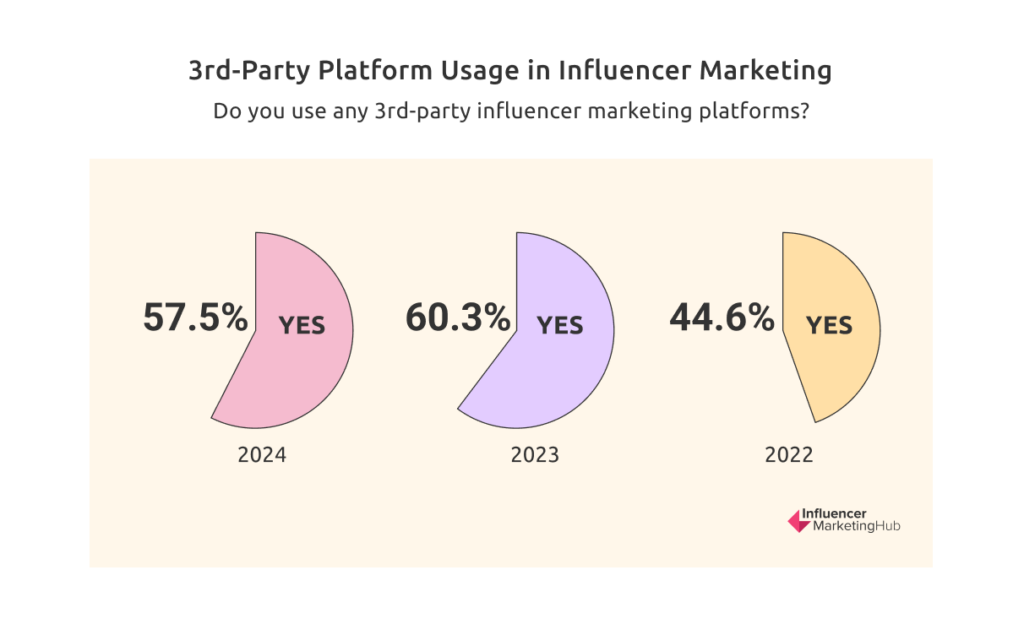

Nearly 60% of All Respondents Use 3rd-Party Platforms

Just as more firms use in-house tools for influencer marketing compared to previously, noticeably more also use third-party platforms. When asked whether they use third-party platforms to assist them with their influencer marketing, 57.5% said they did (60.3% in 2023).

A clear majority of firms now recognize the advantages of using technology to assist them with their influencer marketing.

We must also remember that these figures exclude brands that opt to use someone else’s technology (an agency) to carry out much of their influencer marketing for them).

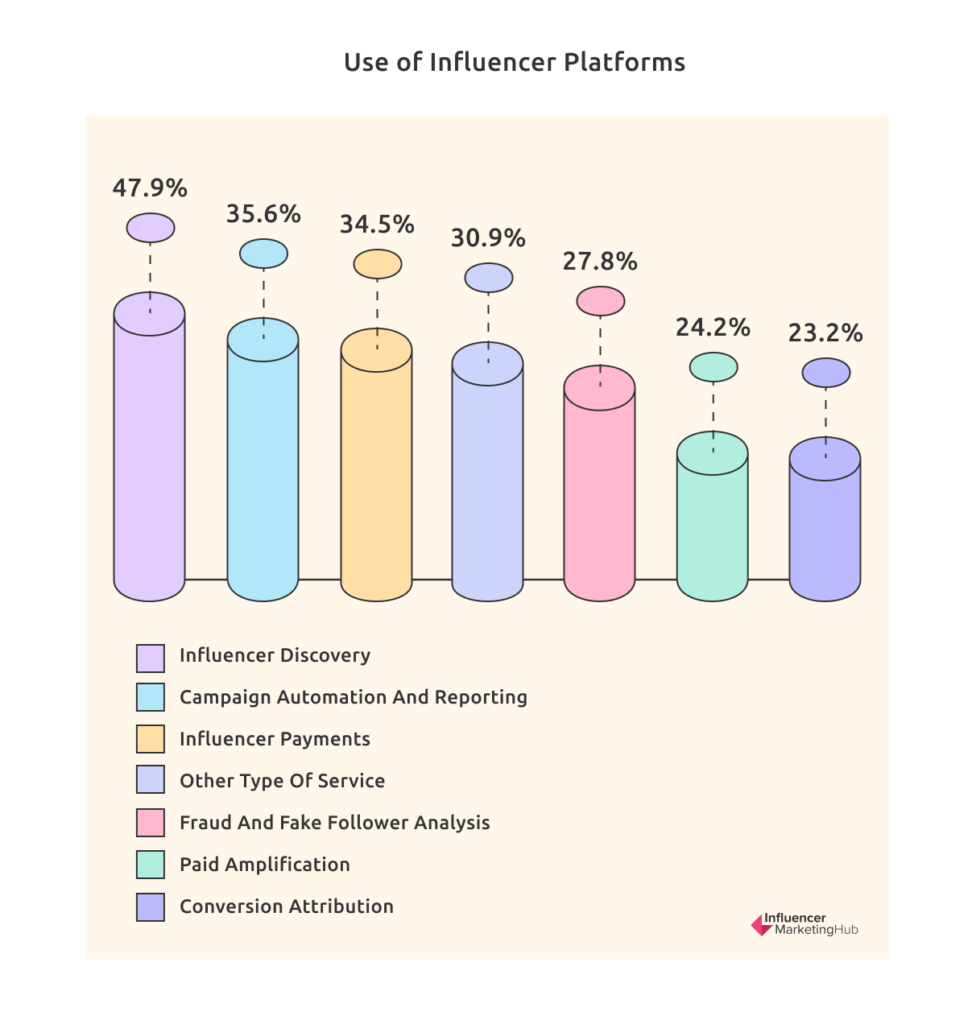

The Most Popular Use of Influencer Platforms is for Influencer Discovery and Communication

The figures in this section show a percentage of those who answered that they use a third-party platform, not the percentage of all survey respondents as a whole.

Influencer platforms initially focused on offering tools to help with influencer discovery. Therefore, it should be no surprise that that is still the most popular use of influencer platforms at 47.9% (although down slightly from last year’s 54%).

Other popular uses of the influencer platforms include campaign automation and reporting (35.6%), influencer payments (34.5%), fraud and fake follower analysis (27.8%), paid amplification (24.2%), and conversion attribution (23.2%). An additional 30.9% of respondents use the platforms for some other type of service. The percentage of respondents using the platforms for these purposes has increased in all categories.

Interestingly many of these percentages are lower than in 2022, but the 26% selecting Other is significantly higher. Clearly, the range of services offered by the platforms has expanded, and many firms now use their newer features.

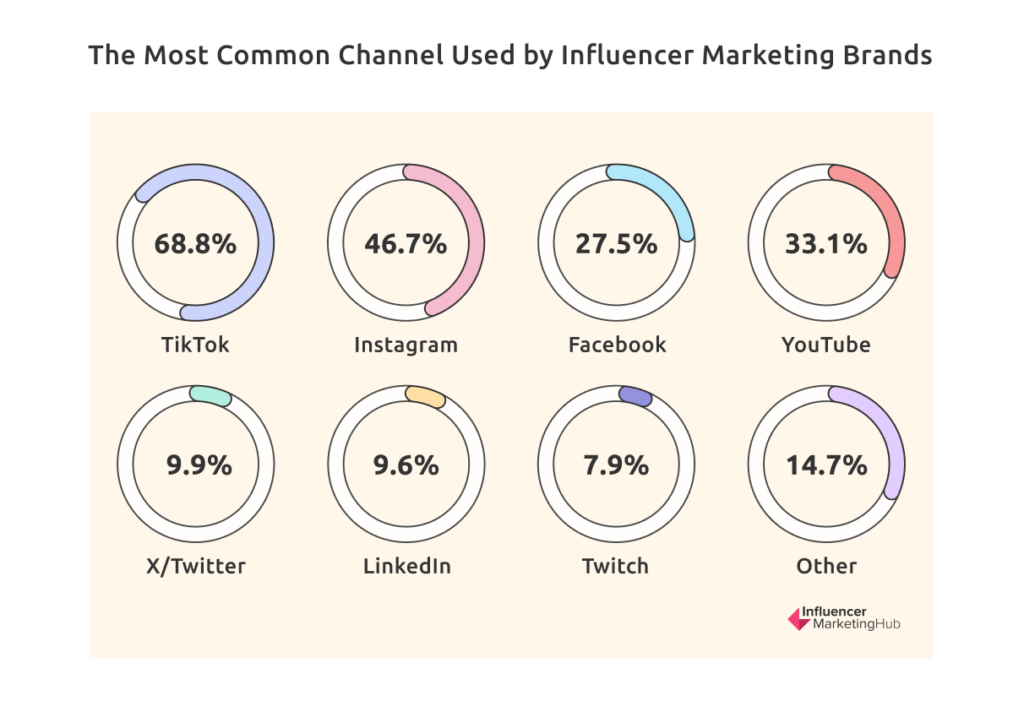

TikTok Continues to be the Most Common Channel Used by Most Brands Engaging in Influencer Marketing

It wasn’t until 2021 that TikTok made its first appearance in our charts, rising from merely being lumped in “Other” in 2020 to 45% usage in 2021. It kept its popularity in 2022, increasing slightly to 46%, but dropping a position to third. In 2023, however, TikTok came into its own, taking over first place, used by 55.5% of brands tapping into it for influencer marketing campaigns.

However, it has really taken off this year, with even grey-haired marketers understanding the importance of including TikTok in their channel mix and now 68.8% of those respondents who engage in influencer marketing include TikTok in the channels they tap into.

From the inception of the IMH Benchmark Report in 2017 until last year Instagram was the network of choice for influencer marketing campaigns. In 2022 it was used by 79% of our respondents for influencer marketing. It is still popular, but this year “only” 46.7% of brands go to Instagram when they decide to participate in influencer marketing, dropping it down to second place. This is the first time we have found fewer than 50% of respondents to include Instagram in their plans.

It wasn’t all that long ago that Instagram was synonymous with influencer marketing. Is it losing its luster? Time will tell.

Surprisingly, Facebook jumped in popularity as an influencer marketing channel in 2023, with 50% of brands working with Facebook influencers, but it fell back to just 27.5% this year. This is interesting, because we saw a resurgence in Facebook popularity in this year’s Social Media Marketing Benchmark Report, indicating a difference in brands’ approaches to Facebook marketing when paying influencers compared to their own marketing efforts. Facebook doesn’t have as many high-profile influencers as its more visual counterparts, but it is still relevant, particularly with older audiences, and has a seasoned advertising marketplace.

Many of the other social channels have seen reduced usage for influencer marketing compared to last year. For example, 33.1% of the respondents tapped into YouTube for their campaigns (38.3% last year and 44% in 2022), 9.9% X/Twitter) (14.4% in 2023, 23% in 2022), 9.6% LinkedIn – presumably those involved with B2B companies (10.1% in 2023, 20% in 2022), 7.9% Twitch (6.3% in 2023, 11% in 2022), and a further 14.7% spread across the less popular or more specialist social networks (12.8% in 2023, 7% in 2022).

X/Twitter’s drop in importance for influencer marketing is notable. Has Elon Musk’s Twitter purchase killed confidence in the platform, or is he a white knight rescuing an already-fading platform?

Bear in mind, the figures here might exceed the usual 100% mark as respondents had the flexibility to select more than one channel for their influencer marketing efforts. This multi-channel approach reflects the diverse strategies brands are adopting in the digital realm.

User Generated Content (UGC) is the Main Objective When Running an Influencer Campaign

The answers to this question have changed markedly over the last few years. In 2022 36.7% of our respondents claimed their influencer campaign aimed to increase sales, 35.7% focused on awareness, and 32.8% declared they participated in influencer marketing to build up a library of user-generated content.

By 2023, however, the wish for generating UGC jumped ahead as the main reason for influencer marketing campaigns (45%), with Sales (29%) and Awareness (26%) both noticeably reduced in importance.

This year sees a similar trend to last year but with even more focus on user-generated content. The desire for generating UGC surged further ahead as the main reason for influencer marketing campaigns (55.8%), with Sales (23.2%) and Awareness (21%) both reducing in importance.

Perhaps this is a sign of the increased importance of TikTok to influencer marketing – TikTok is now the natural home of UGC, with many brands engaging influencers to set up dance challenges and the like on their behalf.

Source: Influencer Marketing Hub

English

English Tiếng Việt

Tiếng Việt Deutsch

Deutsch Japan

Japan